Unlock Faster, More Informed Lending Decisions

Naadi.ai leverages advanced Machine Learning models to provide a revolutionary approach to credit underwriting. We analyze far more than just basic bank statement data. Our in-depth analysis includes income sources and stability, spending habits, money transfer patterns, and cash flow management. This empowers lenders to make data-driven decisions, such as accurate risk assessments for all borrower types, setting fair interest rates, and streamlining the underwriting process.

Transforming Financial Understanding for Informed Decision-Making

Digitisation

Leverage bank statements to provide crucial financial insights across individuals, MSMEs, and corporates. It converts and transforms statements from PDF to digital formats (XML/JSON), facilitating seamless integration into Credit Decisioning and Loan Origination platforms.

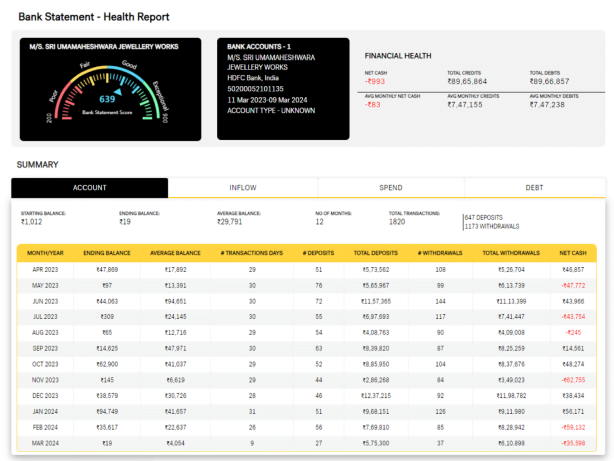

Financial Health Reports

Naadi generates comprehensive Financial Health Reports that summarize income sources, assets, expenses, debts, investments, and more. These reports are invaluable for Credit Underwriters, offering a clear snapshot of the applicant’s financial state to aid in decision-making.

Fund Flow Scores

Naadi calculates Fund Flow Scores based on the applicant’s fund flow data. These scores provide a risk assessment, predicting the probability of loan write-off within the first 12 months. Higher scores indicate lower default probability, enabling accurate risk assessment and pricing strategies.

Predictive Analysis

Naadi uses advance AI/ML models for to generate insights and forecasts, helping lenders make informed decisions. It predicts financial behaviors and outcomes, empowering lenders with the foresight to mitigate risks and seize opportunities in the lending landscape.

Naadi.ai offers a cutting-edge credit underwriting solution powered by Machine Learning. By analyzing over 160 data points from bank statements, Naadi.ai goes beyond traditional methods to create a comprehensive Fund Flow Score. This score provides lenders with a deeper understanding of borrower behavior, enabling them to make faster, more informed decisions. Naadi.ai empowers lenders to implement risk-based pricing, streamline workflows, and expand financial inclusion for borrowers with limited credit history.

Naadi's Salient Features

Streamlined Financial Analysis for Lenders

Bank Statement Processing

- AI/ML based data extraction for both scanned and e-PDF uploaded bank statements.

- Integration with Open Banking APIs for consent-based transactions retrieval.

Insights and Decision Support

- Financial Health Report provides a detailed report about the applicant, aiding underwriters in making informed credit decisions.

- The 3-digit Fund Flow Score predicts the likelihood of a loan being written off within the first year and is readily available through the Cash Flow Score API.

- Naadi.ai offers additional insights around spending, income, and debt via API.

Embeddable UI

- Plug our solution seamlessly into your lending journey.

- Fits into both self-service and assisted loan application journeys.

- White-label the solution to align with your organisation's brand and theme.

Why Naadi.ai?

The Current Problem: Limited Visibility into Borrower Behavior

Traditional credit underwriting relies heavily on basic data points extracted from bank statements. This limited view often fails to capture the full financial health of a borrower, leading to:

- Inaccurate Risk Assessment: Inability to accurately assess risk for different borrower types can result in bad loans and financial losses for lenders.

- Limited Lending Opportunities: Borrowers with limited credit history or non-traditional income streams are often unfairly excluded from accessing credit.

- Difficulty Setting Optimal Loan Terms: Without a comprehensive understanding of a borrower’s financial situation, lenders struggle to set appropriate interest rates and loan terms.

How Naadi.ai helps

Naadi.ai addresses these challenges head-on with a next-generation credit underwriting solution. Our advanced Machine Learning models analyze over 160 data points within bank statements, providing a holistic view of borrower behavior.

Naadi.ai goes beyond the basics by analyzing:

- Income Sources and Stability: We delve deeper to understand the consistency and reliability of a borrower's income.

- Spending Habits and Financial Commitments: By analyzing spending patterns, we can assess a borrower's financial discipline and ability to manage debt.

- Money Transfer Patterns: Analyzing transfers can reveal responsible financial management practices.

- Cash Flow Management: We assess a borrower's ability to manage their cash flow effectively.

Naadi.ai empowers lenders through a comprehensive analysis of borrower behavior. This translates to data-driven decision making with the Fund Flow Score enabling accurate risk assessment for all borrower types. Lenders can expand their reach by identifying creditworthy individuals who may have been overlooked traditionally. Additionally, a deeper understanding of borrower profiles allows for setting fair and responsible interest rates, fostering financial inclusion and responsible lending practices for both lenders and borrowers.

Naadi.ai - Fund Flow Score

A Multi-Dimensional Analysis

Naadi.ai goes beyond basic bank statement analysis to generate the powerful Fund Flow Score. We analyse over 160 transactional features, extracting key financial behaviours to create a holistic view of an applicant’s financial health. This score leverages six core categories to paint a comprehensive picture.

01

02

03

04

05

06

Naadi.ai’s models aren’t limited to the information available within the bank statement. It takes a sophisticated approach by considering what’s missing as well.

Here’s how it works:

- It identifies transaction categories typically found in similar borrower groups – Cohort Analysis.

- If these categories are absent from an applicant’s bank statement, it can influence their Fund Flow Score.

- This approach provides a more nuanced understanding of an applicant’s financial behaviour.

Naadi.ai - Financial Health Report

Unlocking Financial Insights

Financial Health Report transforms raw transactional data into meaningful insights, enabling informed decisions by back-office underwriters in the evaluation of loan applications. The report categories data into four essential buckets, providing a comprehensive view of the applicant’s financial well-being.

Bank Transaction Summary

- Monthly view of cash flow, detailing inflows and outflows.

- Graphical representation facilitates the assessment of consistency and activity levels.

Income Breakdown

- Enumeration of different sources of income along with the frequency of income.

Spend Analysis

- Categorisation of spending into discretionary, investment, and sustenance expenses.

- Comparative analysis of spending in relation to income.

Debt Overview

- Detailed listing of disbursed loans, including amount, frequency, and repayment terms.

Ready to unlock the future of lending with Hotfoot?

Our cutting-edge solutions are designed to revolutionise the way you approach lending. Don’t miss out on the opportunity to streamline your operations, reduce risk, and boost profitability. Get in touch with us today to discover how our products can transform your lending business. Your success starts with a conversation.