Designed to transform the lending landscape

With Hotfoot’s comprehensive range of products and robust platform, businesses can revolutionize their lending operations, achieve cost savings, improve compliance, and stay ahead in the dynamic financial industry.

One Platform. Multiple Solutions.

An Integrated, Low Code platform that seamlessly handles secured and unsecured loans

Add-Ons

Lead Management

Digital Channels

Vendor Ecosystem Onboarding

File Tracking and Management

Rapid Plus

Rapid DIY

Digital Lending

Co-Lending

Extend the power of Rapid.ai

Explore Hotfoot's suite of integrated solutions for a seamless loan processing experience.

Go Beyond the Surface

Stop Data Silos, Gain Clarity

Business Rule Engine

Rapid.ai is a Loan Origination Solution based on an agile low-code platform that revolutionises the processing and approval of retail loans. With Rapid.ai, you can expect reduced turnaround time, from days to minutes, ensuring swift loan processing. Our platform offers a single window delivery of an integrated solution, streamlining the loan management process. Experience the power of Rapid.ai and witness the transformation in retail loan processing.

Rapid incorporates a fully integrated, ready-to-deploy Business Rule Engine (BRE) with pre-configured rule sets for multiple products. This powerful engine enables automated decision-making based on predefined rules, ensuring consistent and efficient loan processing.

Automated report generation, bespoke reporting, and scheduled reports for MIS, Essential templates like Sanction Letters and LOD. This enhances decision-making and operational efficiency.

Rapid integrates document handling capabilities with workflow and cloud storage. This seamless integration allows for efficient document management, reducing manual errors, improving data accuracy, and enhancing overall productivity.

Rapid supports multi-method notifications, enabling seamless communication with internal and external stakeholders. Stay updated with real-time notifications, ensuring efficient collaboration and timely actions.

Rapid’s query module is stage agnostic, enabling communication without the need to move the application between stages. This eliminates the reliance on emails, streamlines communication channels, and improves process efficiency.

Users can conveniently access Rapid from their preferred devices, providing flexibility and convenience in their workflow. This enables users to stay productive and connected regardless of their location or device preference.

Workflow Engine

Business Rule Engine

Report Microservices

Third-Party Integrations

Multi Form Factor

Multi Bureau Integration

Real-Time Data Sync

Query Module

Zero Data Entry

Notification System

Digital Document Management

01/

Platform capable of handling both secured and unsecured loans

02/

Single window delivery of an Integrated Platform

03/

Domain and technology expertise are offered as a marriage

04/

Business process consulting is integral within delivery

05/

Continuous focus on research and innovation

Rapid.ai is a comprehensive product that seamlessly integrates origination, decisioning, digital documentation and disbursement processes. With a focus on streamlining workflows, reducing complexity, and enhancing efficiency, Rapid.ai empowers organisations to concentrate on their core business activities. Experience a streamlined lending journey with Rapid.ai, enabling you to maximise productivity and achieve optimal results.

WiseEngine (BRE)

-

Independent Modular Architecture for various Loan Products

-

Independent streamlined workflow for each LOS enabling automated decision-making

-

On Demand Integrations & Services

-

Build-Operate-Transfer approach, we gather program requirements, configure the BRE, and simplify processes, allowing you to streamline operations with WiseEngine.

Zero Data Entry

-

Fully automated onboarding

-

No manual data entry, the sales agent doesn't have to manually input any data

-

ML-based image recognition

-

API integrations for automated verification

-

Instant Go/No-Go decisions

Rapid.ai Add-Ons

Enhance Your Loan Management Experience.

Explore our range of Add-Ons designed to augment and streamline your loan management process. From lead management to file tracking and management, these add-ons offer specialised functionalities to boost efficiency and productivity.

Lead Management

Accelerating Sales Growth and Efficiency

Rapid.ai Lead Management is a comprehensive solution designed to streamline the lead generation, engagement, and conversion process. With its powerful features, it empowers businesses to generate, engage, and convert leads more effectively, leading to faster sales growth. The main functions of Lead Management is to Generate leads, Engage prospective leads and Convert.

Here’s how Rapid.ai Lead Management can benefit your organization:

Generate: Rapid.ai Lead Management simplifies lead generation by providing tools to capture and disseminate leads effortlessly. You can efficiently collect leads from various sources and ensure their seamless integration into the system. This enables your sales team to have a constant inflow of potential customers, driving business growth.

Engage: Engaging and nurturing leads is crucial for successful conversions. Rapid.ai Lead Management helps you enrich your prospect base through effective communication strategies. You can leverage the platform to send personalized messages, follow-ups, and targeted campaigns, ensuring that your leads stay engaged and interested in your offerings.

Integration with LOS: Seamlessly transfers the leads to the Rapid.ai Loan Origination System (LOS) for fulfillment.

Convert: Improving sales efficiency and conversion rates is a key focus of Rapid.ai Lead Management. The platform offers features and functionalities that enhance the sales process, enabling your team to prioritize leads, track interactions, and effectively move leads through the sales pipeline. By streamlining and optimizing the conversion process, you can achieve faster sales growth and revenue generation.

Real-time Dashboards for Stakeholders: In addition to lead management capabilities, Rapid.ai Lead Management provides real-time dashboards with drill-down capabilities. These dashboards offer stakeholders quick access to key metrics and performance indicators. With easy-to-understand visualizations, stakeholders can gain valuable insights and make informed decisions promptly. Whether it’s monitoring lead generation, tracking engagement activities, or assessing conversion rates, the real-time dashboards empower stakeholders with the information they need for quick decision-making.

Experience the power of Rapid.ai Lead Management and drive your sales growth to new heights. From lead generation to conversion, Rapid.ai Lead Management simplifies and optimises the entire lead management process, allowing your business to thrive.

Digital Channels

Seamless Integration and Tracking

Rapid.ai Digital Channels provide a seamless integration for all leads, whether they come through Direct Selling Agents, Business Correspondents, Fintech Platforms, Internet Banking, Mobile Applications, or the Website. With our advanced technology, we bring these leads into Rapid.ai Loan Origination System (LOS) after performing validation checks for new customers and running the Business Rule Engine (BRE) to determine eligibility.

Key Features of Rapid.ai Digital Channels:

Real-time Application Tracking: Stay updated on the progress of applications in real-time. Our Digital Channels offer a tracking mechanism that allows you to monitor the status of applications at every stage of the loan processing journey. From submission to approval, you and the applicant can track the progress effortlessly.

Instant On-screen Eligibility and Offers: Empower your customers with instant eligibility checks and personalised loan offers.

Our Digital Channels provide an on-screen eligibility assessment, allowing customers to know their loan eligibility instantly. This feature enhances the customer experience and enables them to make informed decisions quickly.

With Rapid.ai Digital Channels, you can seamlessly integrate leads from various digital touchpoints and ensure a smooth transition into the loan origination process. Real-time application tracking and instant on-screen eligibility assessments enhance efficiency and provide a superior customer experience.

Vendor Ecosystem Onboarding

Seamless Vendor Onboarding from KYC to Vendor Code Creation

Rapid.ai Vendor Ecosystem Onboarding simplifies and streamlines the process of onboarding various stakeholders, including Business Correspondents, DSAs, Connectors, Dealers, FI Vendors, Technical Vendors, RCU Vendors, and Legal Vendors. From KYC verification to vendor code creation, our platform ensures a seamless and hassle-free onboarding experience.

Key Steps in the Vendor Ecosystem Onboarding Process:

Initiation: The onboarding process begins with the initiation of vendor onboarding requests. Stakeholders can submit the necessary information and documentation required for KYC verification.

Verification: The provided information and documents undergo thorough verification to ensure compliance with regulatory requirements and internal policies. Our system performs the necessary checks and validations to ensure accuracy and authenticity.

Checker: A designated checker reviews the verified information and documents, conducting additional checks if necessary. This step ensures the accuracy and completeness of the onboarding process.

Decision: Based on the verification and checker’s review, a decision is made regarding the vendor’s onboarding. This decision can include approval, rejection, or additional requirements for further processing.

Vendor Code Creation: Upon approval, the vendor code is created in the system, enabling seamless identification and tracking of the vendor throughout the ecosystem. This step streamlines vendor management and enhances operational efficiency.

Transaction Monitoring and Invoice Creation: Once the vendor is onboarded, the Rapid.ai platform enables transaction monitoring and invoice creation for seamless financial processes and accurate record-keeping.

With Rapid.ai Vendor Ecosystem Onboarding, you can achieve zero data entry and automate the onboarding process for various stakeholders. By integrating KYC verification, vendor code creation, and transaction monitoring, our platform ensures a smooth and efficient onboarding experience, reducing manual efforts and enhancing operational effectiveness.

<span data-metadata=""><span data-buffer="">File Tracking and Management System

Streamlined File Tracking and Management with Rapid.ai

Rapid.ai’s File Tracking and Management System is designed to streamline the process of tracking, storing and managing loan-related documents, ensuring seamless communication and efficient handling of files throughout the loan lifecycle.

Key Features and Benefits:

File Management: All Loan related documents starting from Know Your Customer(KYC) to Over-the-Counter (OTC) documents and Post-Disbursement documents (PDD) are are securely relayed to the Branch and Head Offices for processing and safely stored through Rapid.ai File Management – Document Tracker, while also maintaining traceabilty.

Document Tracker: The Document Tracker component receives and manages the flow of documents. It handles the sending of documents to the Regional Center, Head Office, and Storage Warehouses, ensuring proper distribution and storage of loan-related documents. The Document Tracker also continuously monitors the status of the KYC. As the status changes, the system looks for the Over-the-Counter (OTC) documents and Post-Disbursement documents (PDD) to process and store.

Real-time Tracking and Feedback: Throughout the file tracking and management process, Rapid.ai provides constant tracking updates and feedback. This ensures transparency, enables stakeholders to stay informed about the progress of documents, and allows for timely actions and decision-making.

By leveraging Rapid.ai’s File Tracking and Management System, you can ensure seamless coordination, effective communication, and efficient handling of loan-related documents. The system enables real-time tracking, reduces manual efforts, and enhances the overall efficiency and productivity of your loan processing operations.

Rapid Plus

The Ultimate Solution for Microfinancing

RAPID Plus revolutionizes the microfinance industry by combining the capabilities of JLG (Joint Liability Group) lending and cross-selling into a single, powerful platform. With RAPID Plus, microfinance institutions can provide a comprehensive and convenient solution to their clients while improving productivity and reducing costs.

Here are the key functions enabled by Rapid Plus:

Sourcing

- JLG Loans: Facilitate group-based loans where members of a Joint Liability Group collectively guarantee repayment.

- Pre-Approved Loans: Offer pre-approved loan products to eligible clients based on their creditworthiness and repayment history.

- Individual Loans: Provide individual loan products tailored to the specific needs of clients outside of JLG structures.

Collections

- Cash Limit Management: Monitor and manage cash limits for efficient fund disbursement and collection.

- Online Payments: Enable clients to make loan repayments and other transactions conveniently through online platforms.

- Center/Member Receipts: Issue receipts for loan repayments and other transactions at the center and member level.

- Promise to Pay: Record and track client commitments to repay loans within specified timelines.

Cross Sell

- Savings Account: Offer savings accounts to encourage clients to save money and build financial stability.

- Current Account: Provide current accounts for clients who need frequent access to funds for business purposes.

- Fixed Deposit: Offer fixed deposit accounts to help clients earn interest on their savings over a specified period.

- Recurring Deposit: Provide recurring deposit accounts to encourage clients to save regularly for future financial goals.

- Insurance: Offer insurance products to protect clients and their families from unforeseen events and provide financial security.

Rapid Plus by Rapid.ai provides microfinance institutions with a comprehensive platform that enhances efficiency, expands service offerings, and improves client satisfaction through integrated JLG lending, streamlined collections, and extensive cross-selling capabilities.

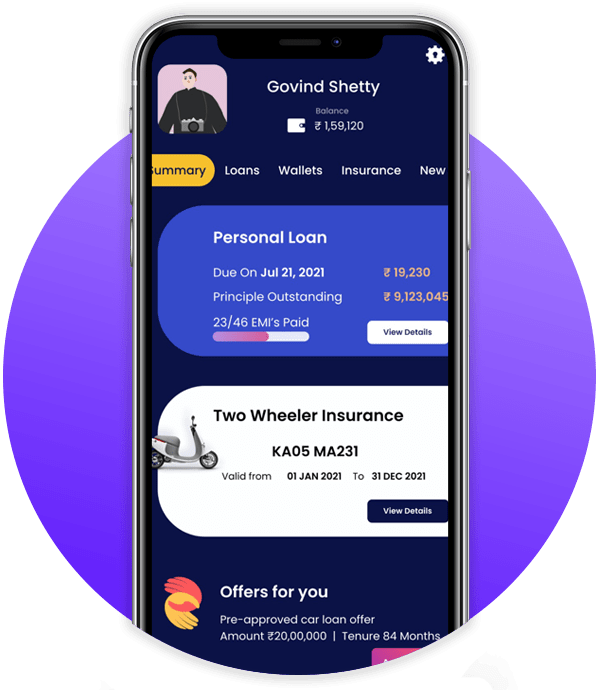

Rapid DIY

Empowering Customers with Self-Service Loan Management

Rapid DIY is a game-changing solution that puts customers in control of their loan journey, offering a range of functions and features to meet their needs. With Rapid DIY, customers can effortlessly avail loans, manage their existing loans, and explore cross-selling opportunities.

Here are the key functions enabled by Rapid DIY:

Availing Loans: Rapid DIY provides a seamless experience for customers looking to avail loans. Whether they are new to the bank or existing customers, they can easily apply for various types of loans, including balance transfers, pre-approved loans, and fresh loans.

Manage Loan: With Rapid DIY, customers have full visibility and control over their loans. They can view loan details, access their repayment schedule, and even initiate foreclosure payments. Additionally, customers have the flexibility to make part-prepayment of their EMIs, ensuring greater financial convenience.

Manage Services: Rapid DIY empowers customers to update their contact details and KYC information conveniently. They can also submit service requests for any loan-related inquiries or requests for statements of account (SOA) and interest certificates.

Cross-Sell: Rapid DIY goes beyond loan management by offering cross-selling opportunities. Customers can explore and avail insurance products, as well as discover other loan and liability products that suit their financial needs, all within the same platform.

Rapid DIY enables customers to take charge of their loan experience, providing a user-friendly interface and seamless functionality. By embracing self-service capabilities, customers can save time, improve convenience, and have greater control over their financial journey.

Digital Lending

<span data-metadata=""><span data-buffer="">Digital Lending Reinvented

Rapid.ai’s Digital Lending add-on empowers you to go beyond traditional credit scores and unlock capital for a wider range of borrowers, particularly MSMEs.

Data Driven Decisions: Unlocking Capital for MSMEs

- Data-Driven Decision Engine: Utilize AI/ML models, scorecards, and profile-based lending to enhance accuracy and efficiency in loan decisions.

Fully Automated End-to-End Journey: Streamline the loan application and approval process for personal and merchant loans, reducing wait times and paperwork.

Transaction Monitoring: Gain valuable insights through real-time funnel analysis and comprehensive transaction data.

Seamless API Integrations: Ensure smooth functionality with robust observability and self-healing API integrations.

Customer Configurable Repayment: Facilitate closed-loop working capital management with configurable repayment options.

Rapid.ai’s Digital Lending solution empowers financial institutions to embrace a future of efficient, data-driven lending, where MSMEs and other borrowers can access capital quickly and transparently.

Co-Lending

<span data-metadata=""><span data-buffer="">Powering Partnerships, Simplifying Processes.<span data-metadata="">

Leveraging Hotfoot’s expertise, Rapid.ai delivers innovative Co-Lending solutions that foster win-win partnerships. The platform streamlines workflows, ensures regulatory compliance (CLM1 & CLM2), and enhances the customer experience.

Key Features for Streamlined Collaboration

Information Sharing via APIs: Rapid provides pre-defined screens or APIs for seamless co-lender collaboration. Co-lenders have the flexibility to use Rapid’s system for end-to-end processes or integrate data into their existing systems. APIs enable information exchange between Rapid and co-lenders, facilitating native system processing.

Multi-Tenant BRE: Rapid configures credit policies for multiple lenders, ensuring accurate decision-making. This approach avoids unnecessary back-and-forth between co-lending entities, leading to smoother workflows and faster Turnaround Time (TAT).

File Upload/Download: Facilitates batch processing for scenarios where APIs are not available in the co-lender’s system. This feature streamlines information sharing through convenient file upload/download capabilities.

Document Generation: Automates the generation of crucial documents such as Sanction Letters and Tripartite Agreements for each co-lending partnership.

Disbursement: Initiates multiple schedules for Loan Creation and Escrow Management, ensuring efficient and timely disbursement processes.

Rapid.ai’s Co-Lending solutions empower financial institutions to collaborate effectively, streamline processes, and deliver enhanced customer experiences through advanced technological integrations and regulatory compliance.

Platform

Unlock the potential of your business with Rapid.ai Platform, an integrated and low-code solution that revolutionizes the way you operate. From digital onboarding to decision automation and document digitalization, our platform offers a comprehensive suite of tools to streamline your processes and enhance productivity.

The backend that Empowers Digital Transformation

Rapid.ai Platform is built on a current generation microservices-based architecture, providing long-term adaptability. It offers an out-of-the-box technology stack, clean REST/JSON interfaces, and smaller granular responsibility for optimized scalability. The platform supports cloud deployment, high modularity, and distributed global deployment. It ensures high availability, scalability, reliable storage, and processing. With de-coupled services, it offers flexibility and efficient management of critical components. Rapid.ai Platform is a robust, secure, and scalable solution for digital transformation and business growth.

- Real-time validation with KYC and Multiple Bureau integration ensures accurate and reliable data for informed decision-making.

- Save time and costs while increasing productivity with our powerful rule engine, enabling quick checks and complete sanctioning.

- Our platform provides a seamless experience across mobile and web platforms, with responsive UI and intuitive status visualization.

- Leverage cutting-edge machine learning models for income estimation, document identification, and image extraction, automating manual processes and improving efficiency.

- With end-to-end audit trails, regulatory compliance, and exhaustively tested security measures, your data is protected at every step.

- Easily leverage over 50 APIs and benefit from a near English rule engine, empowering you to integrate and utilize data from various sources.

User Experience

Data

Machine Learning Models

Security

Key Highlights of the Rapid.ai Platform

Rapid.ai Workflow - Activitii BPM

- Using Activity Engine, workflows navigate using standard BPMN task movement.

- The platform constructs workflows, assembles & triggers each workflow based on events.

- Hierarchy Movements are configurations that allow infinite levels by configuration.

Rapid.ai Business Rule Engine

- Pre-Built Domain Models and Utility functions specific to Loan Decisioning.

- Supports – Excel Driven Rules and dynamic variables, dynamic object creation and injection.

- Define Policy Deviations and Hard Stops within the same rule set.

Rapid.ai Android Framework

- User Defined Fields: addition of dynamic fields without a code change.

- User Defined Screens: change the entire screen for specific screens without a Code change.

- Offline Capability: Ability to perform pre-defined activities independent of network availability.

Scalable Architecture

- Microservices structure enables Individual component scaling depending on Business needs

- Horizontal scalability (Demand based scaling)

- Predefined archival process ensuring.

Rapid.ai Web Framework

- Multi Form factor: allows the user to access the web interface across Form Factors.

- User Defined Fields: addition of dynamic fields without a code change.

- User Defined Screens: change the entire screen for specific screens without a Code change.

Discover the exceptional advantages of Hotfoot’s Rapid.ai platform. From accelerated process transformation and cost savings to enhanced customer experiences and improved productivity, Rapid.ai offers a comprehensive solution that revolutionizes loan processing. With its robust compliance measures, streamlined workflows, and seamless digitization, Rapid.ai empowers businesses to achieve operational excellence and deliver exceptional results.

- Seamless Digital Transformation

- Domain Expertise

- Intelligent Data Insights

- Scalable and Agile Solutions

- Cost Saving

- Innovation-driven Approach

- Reduced Turnaround Time (TAT)

- Compliance

- Improved Productivity

- Enhanced Customer Experience

- Strong Support and Partnership

- Employee Experience

Streamlined Automation for Enhanced Efficiency

With a high percentage of automation across different modules and workflows, Rapid.ai eliminates manual tasks, reduces turnaround time, and minimises the risk of errors. The automation percentage for various processes within Rapid.ai is as follows:

Lead Creation

Application

Financial Approval

Legal

Valuation

FI

RCU

Final Approval

Pricing

PSD Sales

PSD - Credit

Branch Operations

HO Operations

Platform Differentiators

Rapid.ai Platform

LOS

BPM & DMS

Workflow

Product based workflow configuration possible.

Ecosystem Integrations

Micro-services architecture allows unlimited Integrations without a pre-requisite for an ESB.

WiseEngine (Business Rule Engine)

Fully integrated, Ready to deploy BRE with pre-configured rules sets for multiple products.

Mobility

Seamless sync between mobility and web with product antl role specific Ul.

Dedupe Engine

Proprietary Dedupe Engine capable of showing 100K records in 1 second for probabilistic and deterministic search.

Multi Bureau

Pre-configured Multi Bureau connector at platform level. |

Document Management System

Document handling integrated with workflow and cloud storage.

Query Module

Stage agnostic, enabling communication without moving the application between stages and eliminating emails. |

Notifications

Supports multi method notification to internal and external stakeholders.

Report Microservices

100% Digitalization of documents. All are pre-generated, pre-filled and stored.

How can we help in driving Process and Solution Excellence?

Our tailored solutions are designed to empower organizations across diverse sectors, including banks, non-banking financial institutions (NBFI’s) and lending institutions. By leveraging our expertise, businesses can achieve their financial goals, elevate customer experiences, and spearhead digital innovation.

We offer Solutions for the following Products:

- Unsecured Business Loans

- MSME Secured Loans

- Housing Loans

- Personal Loans

- Two Wheeler Loans

- Commercial Vehicle Loans

- Car Loans

- BNPL

- Micro Finance

- Supply Chain Finance

Ready to unlock the future of lending with Hotfoot?

Our cutting-edge solutions are designed to revolutionise the way you approach lending. Don’t miss out on the opportunity to streamline your operations, reduce risk, and boost profitability. Get in touch with us today to discover how our products can transform your lending business. Your success starts with a conversation.